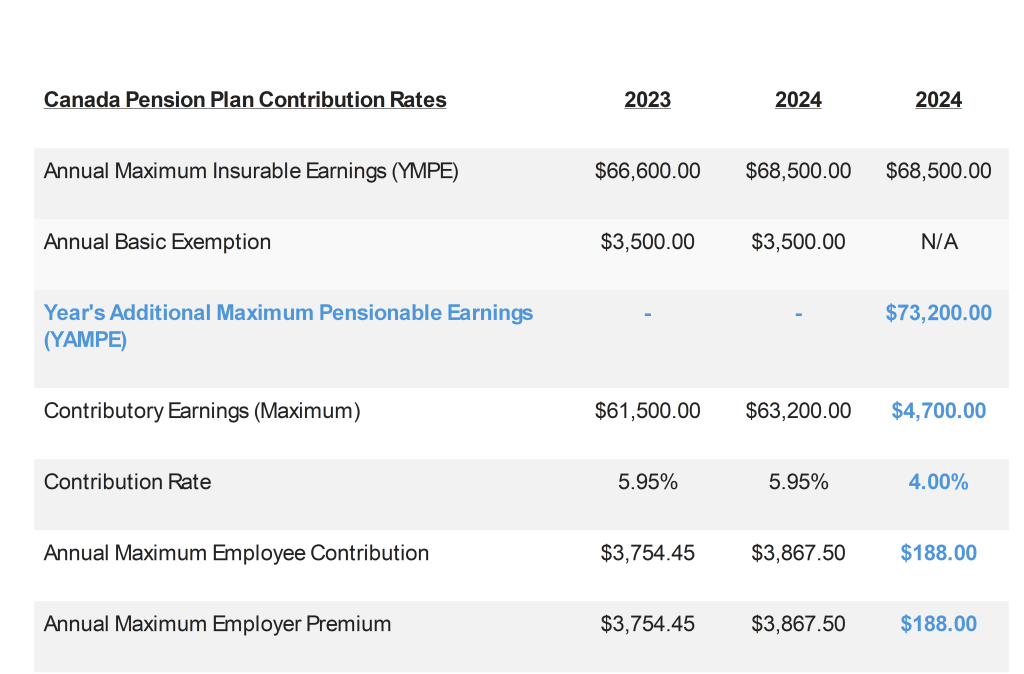

Effective January 1st, 2024, the Canada Revenue Agency (CRA) has implemented significant changes to the Canada Pension Plan (CPP) by the with the aim to provide Canadians with increased retirement benefits. These changes, known as the Enhanced CPP or what you may have seen referred to as “CPP2 deductions”, affect higher income workers earning greater than $68,500 or what is formally known as the year’s maximum pensionable earning (YMPE). NOTE: This is up from the YMPE in 2023 of $66,600.

The key change is the introduction of a second earning ceiling called the year’s additional maximum pensionable earning (YAMPE) which is approximately 7% higher than the current $68,500 threshold at $73,200 for 2024. This will increase further in 2025 to 14% of YMPE.

How second additional CPP contributions are calculated

- For Employees and Employers the CPP2 contribution is 4% of the amount they earn between $68,500 and $73,200 in 2024 with a maximum contribution of $188 each

- For Self-employed individuals the CPP2 contribution is 8% of the amount they earn between $68,500 and $73,200 in 2024 with a maximum contribution of $376.

NOTE: There is no change in the base CPP contribution rate and Annual Basic Exemption for earnings up to $68,500. These remain at 5.95% and $3,500 respectively on YMPE.

Example Scenario

Amrit is an employee and has an annual income of $120,000.

For 2024, given the new YMPE of up to $68,500 he will contribute $3,867 of base CPP calculated as ($68,500 – $3500) x 5.95%.

Given the YAMPE for 2024 of $73,200, Amrit will contribute an additional $188 in CPP2 calculated as ($73,200 – $68,500) x 4%. $188 is the maximum for CPP2. Amrit’s income above $73,200 is not subject to any incremental CPP contributions.

Therefore, Amrit’s total CPP contribution for his salary in 2024 will be $4,055. This will be matched by his employer.

If Amrit was Self-Employed his total CPP contribution for 2024 would be $8,110.

However, there are federal credits and tax deductions available to Amrit on base CPP contributions as an employee or self-employed worker and the team at Gupta Accounting is here to provide expert guidance and support on navigating the complexities of the Enhanced CPP Plan.

Should you require further assistance or information, feel free to reach out to us at info@cpamg.ca or call us at +1 416-748-1329.

Further Resources

Additional information about the CPP enhancement can be found on the CRA website using the following links: